Truckometer - Southbound

Posted: 18-Jul-2024 |

According to the latest Truckometer report, the Light Traffic Index (LTI) fell 2.2% m/m in June, while the Heavy Traffic Index (HTI) fell a sharp 5.2% m/m on top of a fall in May.

Light traffic (motorbikes, cars and vans) is generally a good indicator of the state of demand, as opposed to production. It typically provides a 6-month lead on momentum in the economy – variation in it reflects discretionary spending on outings, movement of couriers and tradespeople etc.

The trend in light traffic remains flat, matching overall economic activity as measured by GDP, but the trend remains firmly downward in per capita terms (using ANZ population forecasts).

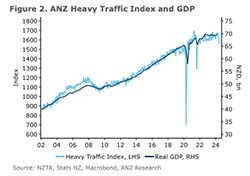

Heavy traffic data (mostly trucks) tends to provide a good steer on production GDP in real time, as it captures both goods production (including agriculture) and freight associated with both wholesale and retail trade.

The heavy traffic index slumped markedly in June, with the 5.2% fall unprecedented outside of lockdowns. Up until June, the data has held up much better than anecdotes about the state of the freight sector, but stories abound of very light truck loadings. Some of the monthly fall could just be data volatility, but it adds to the pile of indicators suggesting Q2 GDP could make for ugly reading. Heavy traffic is 0.9% lower than a year ago (using a three-month average to smooth out volatility), while light traffic is up 0.4%.

+ EQUIPMENT GUIDE - FREE

+ EQUIPMENT GUIDE - FREE